Our next article on how to trade crypto will introduce some of the most commonly used technical indicators which can be used alongside the skills acquired so far in terms of understanding price discovery, price charts, candlesticks and volume.Interactive charts can seem intimidating. Given you are just starting out, it is wise to keep it simple and use volume as part of a general assessment of liquidity (and potential slippage) and as an aid to momentum. What tools choose from among the multitude of potential indicators? These examples are just a few of the possible indicators commonly used in Technical Analysis, and illustrate one of the biggest difficulties facing a Trader. MFI values above 80 are suggestive of a price reversal due to excessive buying volume, whereas a value of 20 or lower may suggest the opposite - excessive selling volume and oversold conditions. Much like Relative Strength Index it is a measure of whether the market is getting overheated. Money Flow Index runs from 0-100 and uses volume as an indicator of overbought or oversold conditions. To calculate OBV start with an arbitrary number say 100, and if daily volume increases add the volume to OBV if it decreases, subtract it. On Balance Volume is a simple measure of the influence of changes in volume that can be correlated with price. A large spike in volume might indicate that laggards are buying into a move as it peaks, exhausting the buyers or sellers, and signalling the end of the move. Though spikes in volume can be associated with new momentum in either direction, they can also signal the tail end of a move, in what is known as Exhaustion. Falling prices on declining volume can equally signal a shift in direction. Rising prices on declining volume can indicate declining momentum and potential reversal.

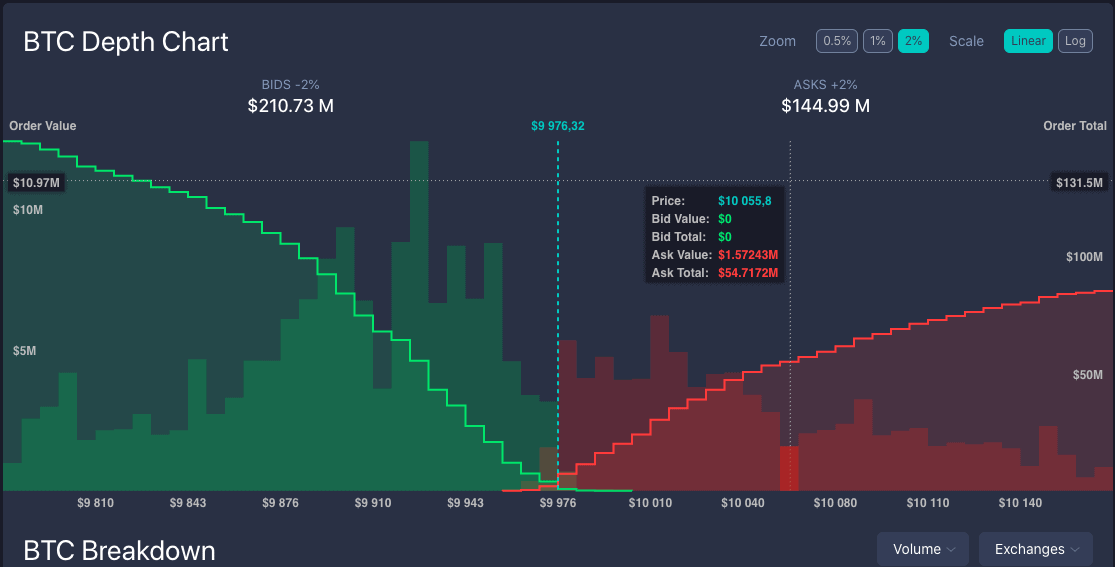

In that way, volume can be a good indicator of price momentum. Increasing volume of buying will push the price of a cryptocurrency higher, but for that to continue, volume must be maintained. The volume indicated is spread across a number of exchanges, each of which will have inefficient markets for anyone wanted to buy and sell the Shopping coin.Ĭoinmarketcap provides a Liquidity Score for each cryptocurrency on the exchanges where it is traded, essentially a measure of how deep the Order Book is, and the likelihood that Buying or Selling will adversely affect the price, what is known as Slippage. The daily volume for Shopping is so low that any significant new volume of trading will have a big impact on the market. This is the data for Bitcoin - ranked no.1 by market capitalisation This is the same information for a coin ranked 500 calling Shopping Websites like Coinmarketcap provide historical volume data. The wider the spread, the less efficient a market and therefore the more volatile. The absence of volume is going to make that really hard - there won’t be enough buyers and sellers, so the difference between the available Offers (buyers) and Bids (sellers) - known as the Spread - will be wide. If, for example, you have an opinion about an obscure cryptocurrency and want to buy it at a specific price. Exchanges choose which coins to trade, and being listed on the bigger exchanges can make a huge difference to volume. It may seem a bit obvious but in order to trade a particular cryptocurrency it has to be listed on an exchange. The change in volume over time will also give you a sense of interest in the project. So when looking at trading a given cryptocurrency, the total volume traded will immediately tell you how volatile it is likely to be. Market participants are an unusual mix of recreational investors (hodlers), miners, speculators and institutional investors each with varying opinions and motivations, with those opinions subject to significant outside influences. Cryptocurrency is inherently volatile because it is immature and its adoption path is uncertain. Mature markets with significant volume and good price discovery have less volatility.

If an equal amount (in terms of volume) is being bought and sold then price will be stable, but stability suggests that people’s opinion about the price are well informed this is known as market efficiency. Remember, price represents the balance of opinions between buyers and sellers. The total volume traded for a given cryptocurrency has a direct relationship with how volatile it is.

0 kommentar(er)

0 kommentar(er)